This content is written and researched by eXp World Holdings subsidiary Zoocasa. This award-winning prop-tech company uses data and technology to deliver an intelligent, end-to-end real estate experience. View the original article here.

_________________

Unstable borrowing conditions and a lack of affordable properties kept homeownership out of reach for many Americans in 2023. However, as the spring buying season approaches and signs that the market is recovering emerge, buyer sentiment is shifting. According to the National Association of Realtors®, national existing home sales in

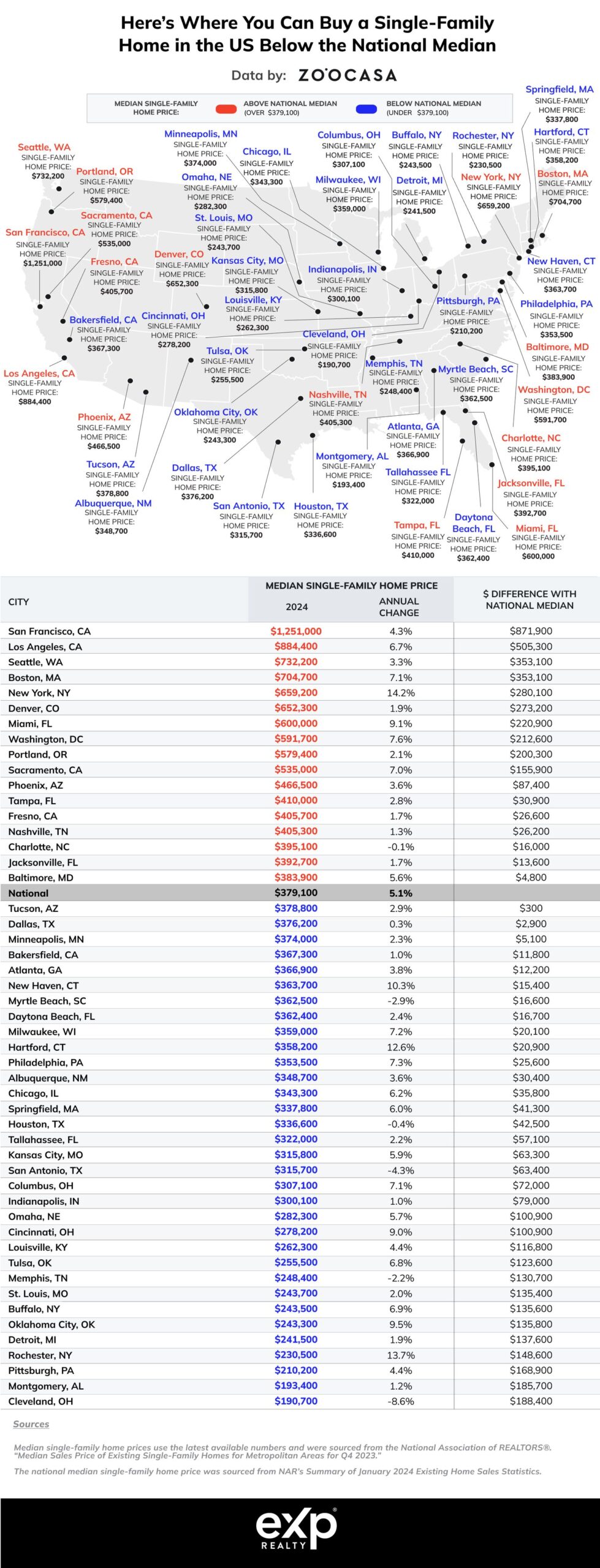

These positive changes are setting the stage for an active spring market in the U.S. But as competition increases, so do home prices. The national median price for a single-family home in the U.S. increased by 5.1% year-over-year in January to $379,100. This begs the question: where can prospective homebuyers find the best deals this spring?

To better understand where homebuyers can find pockets of affordability, Zoocasa analyzed home prices in 50 metropolitan statistical areas across the country to determine which are below the national median and where the most growth is happening. Median single-family home prices were sourced from the National Association of REALTORS® and are from Q4 2023, except the national median home price which is from

33 of 50 Markets Have a Median Home Price Below the National Median

It’s usually said that the further outside of an urban center you go, the more affordable the home price. But of the 33 metropolitan statistical areas with a median home price below the national median, 15 have populations above 2 million, and five have populations above 5 million. The largest urban center with a median home price below the national median is Chicago, IL with a median home price of $343,300 in Q4 of 2023. Despite the city experiencing year-over-year price growth of 6.2%, Chicago’s median home price is still $35,800 below the national median.

Of the 50 markets we analyzed, Cleveland, OH came out on top for affordability. Cleveland’s median home price of $190,700 is an impressive $188,400 below the national median and is one of the few areas on our list where the median home price dropped from last year. Other markets where the median home price fell from last year include Myrtle Beach, SC, Houston, TX, San Antonio, TX, and Memphis, TN. Alabama’s capital, Montgomery, was the only other market on our list besides Cleveland with a median home price below $200,000. Homebuyers here can snag a home for approximately $185,700 below the national median.

It’s worth noting that five out of the six markets that experienced year-over-year price growth of more than 9% have home prices below the national median. These markets include Rochester, NY, Hartford, CT, New Haven, CT, Oklahoma City, OK, and Cincinnati, OH. This means that homebuyers of all price ranges, including those purchasing lower-priced homes, can still expect to build a significant amount of equity.

Markets that have experienced significant year-over-year price growth also present good investment opportunities. For instance, single-family homes in Philadelphia, PA have experienced year-over-year price growth of 7.2% and are still $20,100 below the national median price, making this sought-after city a good option for first-time investors. Kansas City, MO is an emerging market that would make a great first-time investment location. The city garnered a lot of media attention last year thanks to the city’s football team and frequent Taylor Swift visits, resulting in the median home price rising by 5.9% year-over-year. Despite its growing popularity, the median home price in Kansas City remains one of the lowest on our list at $315,800.

Homebuyers May Need to Consider Alternative Markets to Reach Homeownership Goals

Homebuyers with their hearts set on a particular destination, especially one of the largest and most sought-after cities in the US, would benefit from considering smaller markets relatively close to their dream location. While the Big Apple might be out of reach for the average buyer, with a median home price of $659,200, New York’s second and third-largest cities still maintain affordable prices. Buffalo and Rochester have median home prices of $243,500 and $230,500 respectively. This is nearly $150,000 less than the national median, compared to New York City, where the median home price is more than $280,000 above the national median.

Though San Francisco and Los Angeles have notoriously high home prices, at $1,251,000 and $884,400 respectively, California homebuyers still have affordable options. At just $26,600 above the national median, Fresno’s median home price is one of the more affordable options in California. But for savvy buyers looking for a deal in California, Bakersfield presents the best option with a median home price of $11,800 below the national median.

In Florida, motivated buyers on the hunt for affordable prices will have to look outside of the vibrant Miami market, which has a median home price more than $200,000 above the national median. Tampa’s median home price exceeds the national median by just $30,900, while Daytona Beach and Tallahassee offer more affordable housing, with median prices $16,700 and $57,100 below the national median, respectively.

Subscribe to Zoocasa’s free weekly newsletter to get real estate market insights, news, and reports straight to your inbox.