This content is written and researched by eXp World Holdings subsidiary Zoocasa. This award-winning prop-tech company uses data and technology to deliver an intelligent, end-to-end real estate experience. View the original article here.

_________________

Prospective homebuyers in the U.S. have been eagerly waiting for lower mortgage rates following the sky-high rates experienced last year. The Federal Reserve has held the overnight federal funds rate at 5.33% since August, but many economists are predicting rate cuts are coming later this year. In response to slowing inflation, fixed mortgage rates have been on a gradual decline since peaking in November 2023, with some 30-year fixed rates hovering under 7%.

While homeowners have been grappling with higher mortgage payments, renters have likewise been confronting rising rental costs. From January 2020 to January 2024, according to Rent.com, the national median asking rent increased by 24% from $1,584 to $1,964. Considering this, many Americans may be questioning whether to enter the resale market or continue renting this year.

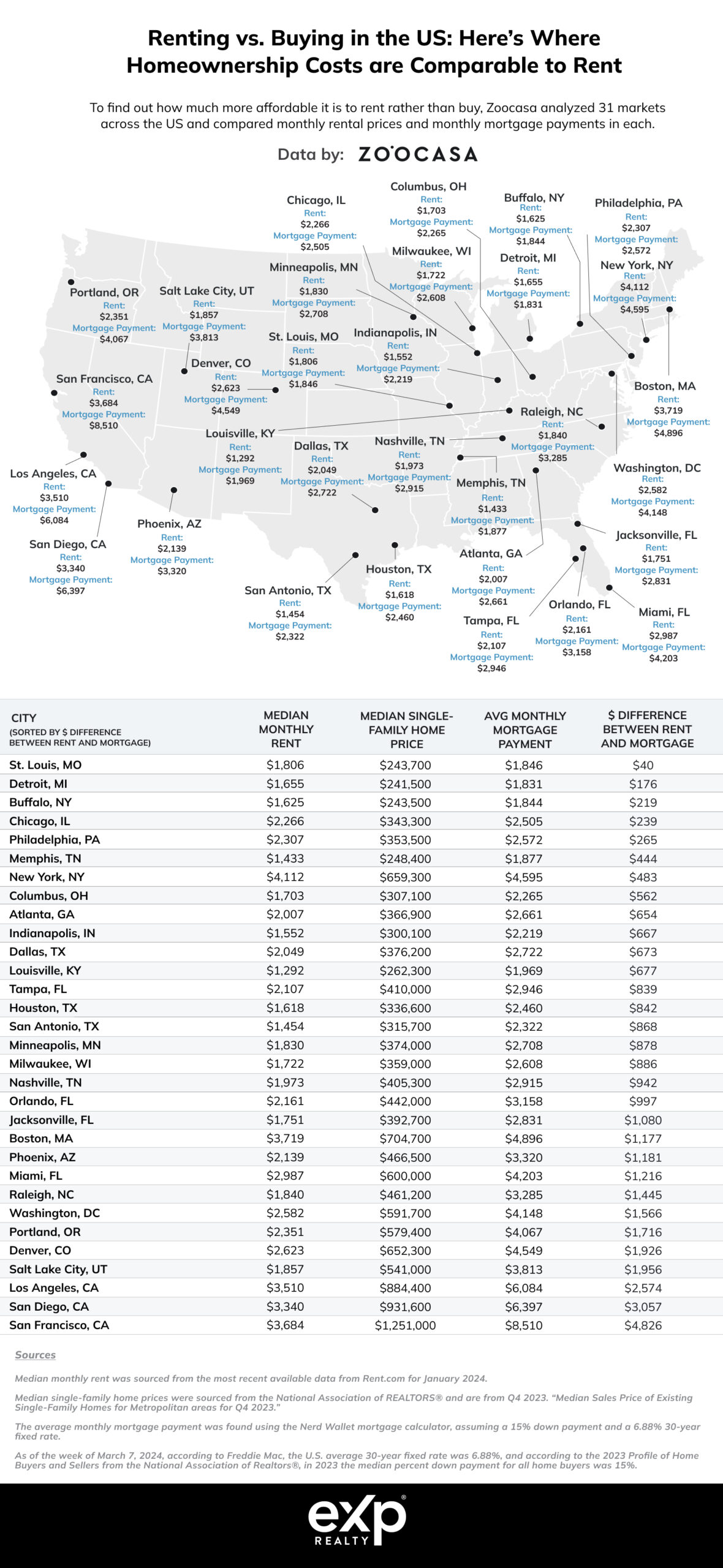

To find out how much more affordable it is to rent rather than buy, Zoocasa analyzed 31 markets across the US and compared monthly rental prices and monthly mortgage payments in each. Additional costs were not considered, such as utilities or property taxes.

Rental price numbers were sourced from Rent.com’s February 2024 Rent Report. Median single-family home prices were sourced from the National Association of REALTORS® and are from Q4 2023. Monthly mortgage payments were calculated using the Nerd Wallet mortgage calculator, assuming a 15% down payment and a 6.88% 30-year fixed rate.

As of the week of March 7, 2024, according to Freddie Mac, the U.S. average 30-year fixed rate was 6.88%, and according to the 2023 Profile of Home Buyers and Sellers from the National Association of Realtors®, in 2023 the median percent down payment for all home buyers was 15%.

7 Cities Have Less Than a $500 Gap Between Monthly Mortgage and Rent

Although it is more affordable to rent than buy in all of the cities we analyzed, six markets stand out for resale affordability. St. Louis, MO, Detroit, MI, Buffalo, NY, Chicago, IL, Philadelphia, PA, Memphis, TN, and New York, NY all have less than a $500 gap between the median rent and the average monthly mortgage payment, giving homebuyers in those cities a unique opportunity to consider homeownership as a financially viable option compared to renting.

In St. Louis, MO the median rent is $1,806, while the average monthly mortgage payment is just $40 more at $1,846. Of the 30 markets we analyzed, this is the smallest difference between rent and mortgage, positioning St. Louis as one of the best cities for homeownership. However, both Detroit, MI and Buffalo, NY have more affordable average monthly mortgage payments at $1,831 and $1,844 respectively. Detroit has the second-smallest gap between median rent and average mortgage, with a difference of $176, followed by Buffalo with a difference of $219.

Chicago, IL, Philadelphia, PA, Memphis, TN and New York, NY round out the list of cities with less than a $500 gap between median rent and average monthly mortgage payments. Of the four, Memphis has the most affordable median home price at $248,400. Memphis also has the second-lowest median rent on our list at just $1,433.

This translates to a $444 difference between the median rent and the average monthly mortgage payment. Surprisingly, in Chicago and Philadelphia, the gap is less than $300 in both, however median rent and average monthly mortgage costs are above $2,200 in each. New York has the highest asking rent on our list at $4,112, so despite having a median home price of $659,300, the difference between rent and mortgage is just $483.

Despite having gaps of more than $500 between monthly mortgage and rent, some cities still have affordable housing options. For example, Louisville, KY has the most affordable median rent on our list at $1,292 and is one of just five cities with an average monthly mortgage payment under $2,000. San Antonio, TX has the third most affordable rent on our list at $1,454 and compared to other large metro areas, has an affordable average monthly mortgage payment of $2,322.

Even in high-demand markets such as those in Florida, homebuyers can find pockets of affordability. Jacksonville, FL has more than a $1,000 difference between median rent and the average monthly mortgage payment, however, it is the most affordable Floridian city on our list for both renting and buying.

Most Expensive Cities Have the Largest Gaps Between Rental and Homeownership Costs

Increased borrowing costs put pressure on landlords to raise asking rents, resulting in the most expensive cities for homebuying to also have the most expensive rental prices. With the highest median home price on our list, San Francisco, CA has both the highest average monthly mortgage payment and the largest gap between rental and homeownership costs. The median rent in San Francisco is $3,684, while the average monthly mortgage payment is a staggering $8,510. This translates to a $4,826 difference between the median rent and the average monthly mortgage payment. San Diego, CA and Los Angeles, CA follow, with respective differences between rent and mortgage payments of $3,057 and $2,574.

Though Boston, MA has only the fourth highest median home price at $704,700, asking rent in the city surpasses that in San Francisco and Los Angeles. The median rent in Boston is $3,719 and the average monthly mortgage payment is $4,896, bringing the difference in rent and mortgage to just $1,177. Other cities with median home prices above the national average and with less than a $1,500 difference between monthly rent and mortgage costs include Miami, FL, Phoenix, AZ, and Raleigh, NC.